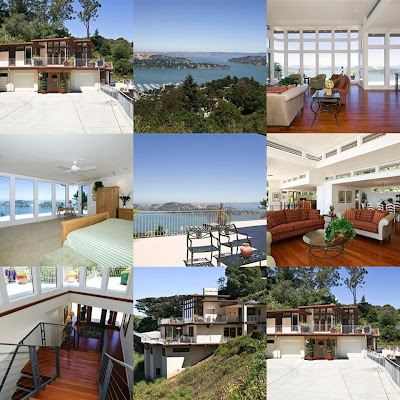

(Remember - click on photos to enlarge)

Spectacular 3 level contemporary home w/ world class views in a private setting, yet just minutes to San Francisco! Fab Open floor plan with breathtaking views from most every room! Ideal for sophisticated entertaining! Home features:Living room w/ marble fireplace; all gourmet kitchen; stunning Master Suite; 3 add'l bedroom suites; 4 full baths & 2 half baths; fully wired media room; office; library. .. this home has it all!

Sausalito, CA 94965

Price: $3,675,001

Beds: 4

Baths: 5

Sq. Ft.: 5,000

$/Sq. Ft.: $735

Lot Size: 0.59 Acres

$/Acre: $6,271,331

Year Built:2003

Stories: 3 Stories

Style: Contemporary

View(s): Bay, Bridges, Hills, Lights, Marina, Water

Area: Sausalito

County: Marin

If you'd like to buy this home please shoot me an e-mail - michael@valleyfinance.com

Here are some things you may or may not know about the wonderful town of Sausalito:

-Located at the north end of the Golden Gate Bridge.

-The novelist Amy Tan is a resident of Sausalito.

-Scenes in the 1947 film The Lady from Shanghai, directed by Orson Welles, take place on the Sausalito waterfront.

-In Star Trek IV: The Voyage Home, the fictional Cetacean Institute is located in Sausalito

-In the television series Star Trek: Enterprise, a Vulcan "compound" is based in Sausalito, although it is not depicted; Fort Baker, which borders Sausalito is shown, and has become the site of Starfleet Headquarters.

- In Jack Kerouac's On the Road, Sausalito is mentioned as "a little fishing village" and a joke is made about it being "filled with Italians."

Huey Lewis and the News and the Dave Matthews Band recorded albums in Sausalito.

The Real Thing, Faith No More

Load, Reload, and Garage Inc, Metallica (at The Plant Studios)

The drums on Breaking the Silence, Heathen (at Studio D)

Rumours, Fleetwood Mac

Ferro e cartone, Francesco Renga(at The Plant Studios)

Live Lycanthropy by Bay Area Band Papa Wheelie was recorded at The Plant Studios.

Talkin' Blues, Bob Marley and The Wailers

Click Here for photo tour of downtown Sausalito.

Click Here for more in depth photos of Sausalito.

We all know Ed has Johnny Carson's side kick and the Publisher Clearing House spokesman.

We all know Ed has Johnny Carson's side kick and the Publisher Clearing House spokesman.