FinCEN Releases Updated Mortgage Fraud ReportMore Suspected

Fraud Being Intercepted Before Funds Were Disbursed

VIENNA, Va. - The Financial Crimes Enforcement Network (FinCEN) recently released an update to its November 2006 mortgage loan fraud assessment, which is based upon analysis of

suspicious activity reports (

SARs) provided by the financial industry. The previous study examined a statistical sample of SARs reporting mortgage fraud filed between April 1996 and March 2006. This updated study continues the analysis for reports filed through March 2007.

As compared to the previous ten years of SAR reporting, data analysis for the most recently studied time period indicates a 50 percent increase in the number of SARs that reported intercepting the suspected fraud prior to funding a mortgage.

This indicates growing vigilance and awareness in the financial community.

"FinCEN's analysis indicates that the financial community is becoming increasingly adept at spotting and reporting suspicious activities that may indicate mortgage fraud," said FinCEN Director James H. Freis, Jr. "This exemplifies how compliance with Bank Secrecy Act regulations is consistent with a financial institution's commercial concerns."

FinCEN noted a 44 percent increase in SARs reporting mortgage fraud in 2006. Analysis of the more recent data indicates that many identified trends continued and certain suspicious activities showed marked increases.

For example, reports of identity theft in conjunction with mortgage fraud SARs increased 96 percent from the previous study. In

2006, there were 37,313 mortgage fraud SARs filed. The

final total for mortgage fraud SARs filed in 2007 was 52,868, an increase of 42 percent. According to FinCEN's most recent SAR data report The SAR Activity Review; By the Numbers, the suspicious activity characterization Mortgage Loan Fraud was the third most prevalent type of suspicious activity reported, after Bank Secrecy Act/Structuring/Money Laundering and Check Fraud.

"Fraud is a growing concern for all mortgage lenders, one which hurts everyone involved in the mortgage process, lenders and consumers alike," said Kieran P. Quinn, CMB, Chairman of the Mortgage Bankers Association. "This report is the authoritative source for data on fraud perpetrated against mortgage lenders and one which our members rely heavily on to spot trends and stay one step ahead of the fraudsters. We look forward to continuing to work with law enforcement to reduce or eliminate mortgage fraud."

Richard Riese, Senior Vice President, at the American Bankers Association's Center for Regulatory Compliance noted, "FinCEN's periodic trend analysis publications, as exemplified by the FinCEN Mortgage Loan Fraud Update, are a worthwhile ancillary benefit of the SAR process that holds up a mirror to industry experience, enabling financial institutions to learn from the aggregated reporting of all. The Update demonstrates that in this period of mortgage crisis we also have witnessed a substantial increase in fraudulent activity that targets both lenders and borrowers."

"[This study] is an excellent example of the value of suspicious activity reporting," said Sharon Ormsby, Section Chief of the Financial Crimes Section, Criminal Investigation Division of the FBI. "These types of SAR-based assessments are not only of benefit to law enforcement in assessing crime problems and trends, they also provide valuable feedback to the financial institutions who report the information."

"The Independent Community Bankers of America (ICBA) is encouraged by this use of the SAR data submitted by banks," said Robert G. Rowe III, Senior Regulatory Counsel for the ICBA. "Especially with current conditions in the mortgage markets and the desire of the nation's community banks to provide solutions for borrowers, it is helpful to give banks information they can use to protect themselves and their customers from mortgage fraud. ICBA strongly encourages FinCEN to continue this type of analysis and feedback."

###

The mission of the Financial Crimes Enforcement Network is to safeguard the financial system from the abuses of financial crime, including terrorist financing, money laundering, and other illicit activity. We achieve this mission by: administering the Bank Secrecy Act; supporting law enforcement, intelligence, and regulatory agencies through sharing and analysis of financial intelligence; building global cooperation with our counterpart financial intelligence units; and networking people, ideas, and information.

P. Rodger Nelson a.k.a Prince a.k.a Artist Formerly Known as Prince a.ka. -----(This logo)

P. Rodger Nelson a.k.a Prince a.k.a Artist Formerly Known as Prince a.ka. -----(This logo)

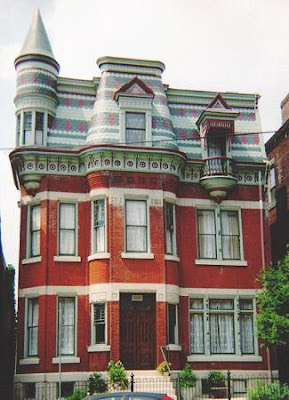

The pop star is paying $200,000 a month for the house, in the Beverly Park enclave of Beverly Hills, Calif. Homes across the street are owned by the Saudi royal family. The neighborhood residents abide by a 70-page homeowners' covenant that includes a minimum building size: "No dwelling shall be constructed or maintained on any residential lot which has a floor area less than 5,000 square." The list of stars that have chosen Beverly Park for their home is practically endless: Sumner Redstone recently reportedly bought Sylvester Stallone's old estate, but Stallone kept another Beverly Park home where he currently lives; Martin Lawrence, Eddie Murphy, Denzel Washington and Power Rangers mogul Haim Saban all live in Beverly Park.

The pop star is paying $200,000 a month for the house, in the Beverly Park enclave of Beverly Hills, Calif. Homes across the street are owned by the Saudi royal family. The neighborhood residents abide by a 70-page homeowners' covenant that includes a minimum building size: "No dwelling shall be constructed or maintained on any residential lot which has a floor area less than 5,000 square." The list of stars that have chosen Beverly Park for their home is practically endless: Sumner Redstone recently reportedly bought Sylvester Stallone's old estate, but Stallone kept another Beverly Park home where he currently lives; Martin Lawrence, Eddie Murphy, Denzel Washington and Power Rangers mogul Haim Saban all live in Beverly Park.

(On 3 acres)

(On 3 acres)