(Read how paradise provides maximum value for the dollar below)

Living The Dream In America

(The sign reads - Aloha, slow down

your in Molokai)

Read more about this near end of posting - Molokai, Hawaii ---->

Many people say, "We will never be able to afford a DREAM home." I tell them -

your looking in the wrong area. If you

look around the country some areas are ripe with large homes, on large lots for small prices. I have seen

nice homes under 100K on 1 or 2 acre lots. Some people nearing

retirement say they are

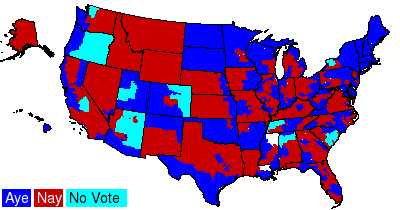

nervous about the cost of living - I tell them sell your California home and pay cash for something in the southeast. Of course in the south east your going to get a slower pace of life, peace and quite, low property tax, less crime and cleaner air, a lot of lakes, ponds and rivers to fish and pass the day. I enjoyed living in the south because the people were so friendly and nice. 3 times I moved in 10 years and guess what? Each time I moved the neighbors brought me a cake and welcomed me to the neighborhood. I have lived in my California sub division at triple the price (no I am not upside down), smaller home, smaller lot and I'm not sure what my neighbors name is...Imagine if you didn't want all this space and were a single person - imagine what you could get a 1000 sq ft for? Under 100K..In essence here is a common person retirement plan. Sell your California home - pay cash for your retirement home in the southeast and pocket the difference in the fund of your choice. Something is "right" when people say "good morning" at the local post office, something is "right" when one neighbor helps another, something is very right when you can live a dream and have money left over. Who wouldn't love buying groceries from a neighborhood store (farmer) vs. a big box? Having run a business in the south I can also say the work ethic is second to none. I suppose the cost of living is so high in California people are focused on work, work and work that no time is left to live, live, and live. 200k- 300K; that is the 10 year equity difference in many higher priced markets. Equity difference = cash money on your next home? You don't have to live with the traffic, the crime, the high cost of living, but I suppose we being creatures of habit would rather stay put then take action to force a change.

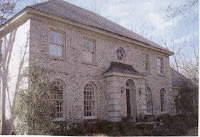

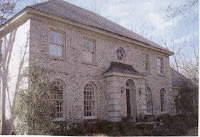

$249,000

Bennettsville, South Carolina

This historic built in

1904 has

5BR/2.5BA with 4800+/- sq ft and is a licensed Bed & Breakfast. The home features beautiful stained wood throughout, wainscoting, stained glass, front and rear staircases, and zoned heating and cooling. The home also has a detached double garage and pool with deck.

Click here to see some more nice photos. Plus this home is on over an acre... Bennettsville is about 30 to 45 min from heavy metro area Charlotte. Bennettsville is not trailor park, Bennettsville is very nice.

$285,000.00

Hartsville, SC

Remarks: SELLER WILL PAY $3000 TOWARDS

BUYERS CLOSING COSTS!! Custom design &

custom built home. Newly painted interior & new carpet. Built in bookcases,

entertainment center, wired for sound downstairs, large pantry, shared fireplace between den & kitchen.

4 bedroom 3 bath 3200 sq ft

$299,000.00 Florence S.C

Remarks:

Beautiful home with lots of living space. This house has

6 bedrooms and 4.5 baths on a .46 acre lot, recently renovated with tile, paint and hardwood floors -

Molokai

Molokai, Hawaii $289,000

Very neat and clean plantation style home. Large landscaped and fenced yard with fruit trees. Centrally located in

Kaunakakai Town. Walking distance to shops, community pool, hospital and elementary school. 3 bedrooms and 1 bath within main house.

Molokai is one of the most wonderful places in the world. This small island is a simple 5 min plane ride to Maui, a few extra min. to any of the other island(s). If you hate crime, love great weather, enjoy bird watching, living Hawaiian culture consider the islands. Yes, many homes are in the multi millions in prime locations in the Hawaiian Islands - but some of the less populated islands and areas provide living environments that are truly priceless. This is one of the reasons I love [American] Real Estate, truly special homes in special places because of the special people - and not becasue of the size of the homes, the cost of the homes. It would not suprise me if you never saw a STOP LIGHT (becasue the last I knew - Molokai has no stop lights)- Molokai is like that - a small island in the huge Pacific with a friendly culture - what a place.

you don't need to travel clear across the globe to remote islands - Molokai is a (somewhat) short plane ride from the west coast of the United States. Paradise, the good life and LIVING FOR A LIVING can still be had for far less then a King's ransome.

Click here and see the Molokai Cowboy Connection - what could be better in Paradise then horse riding on a ranch with the south pacific being your back drop.

Surreal? Indeed - rememebr its paradise....

Fannie Mae Cheat sheet : New Guidelines Start Monday, June 2, 2008

Fannie Mae Cheat sheet : New Guidelines Start Monday, June 2, 2008

$299,000.00 Florence S.C

$299,000.00 Florence S.C